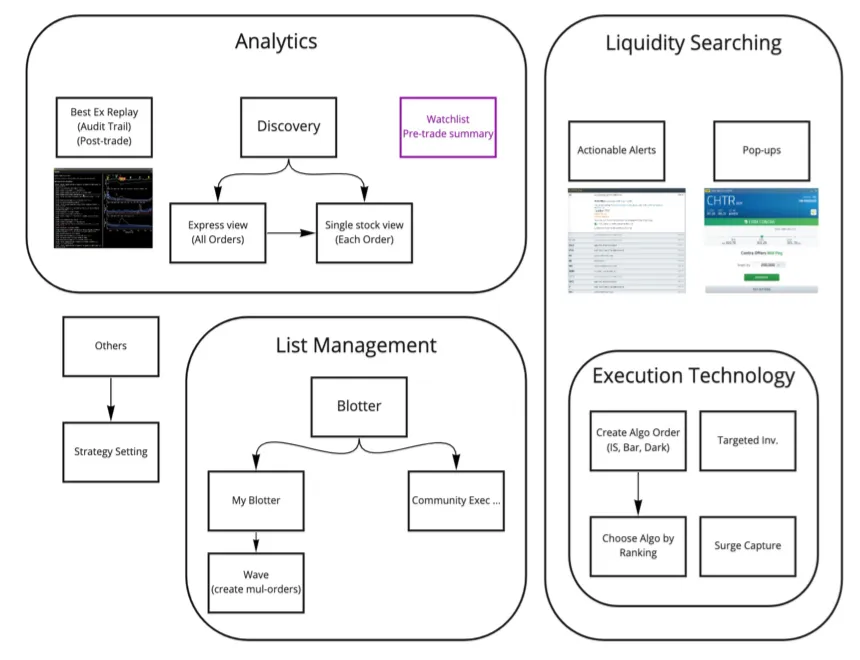

Alert system for institutional traders

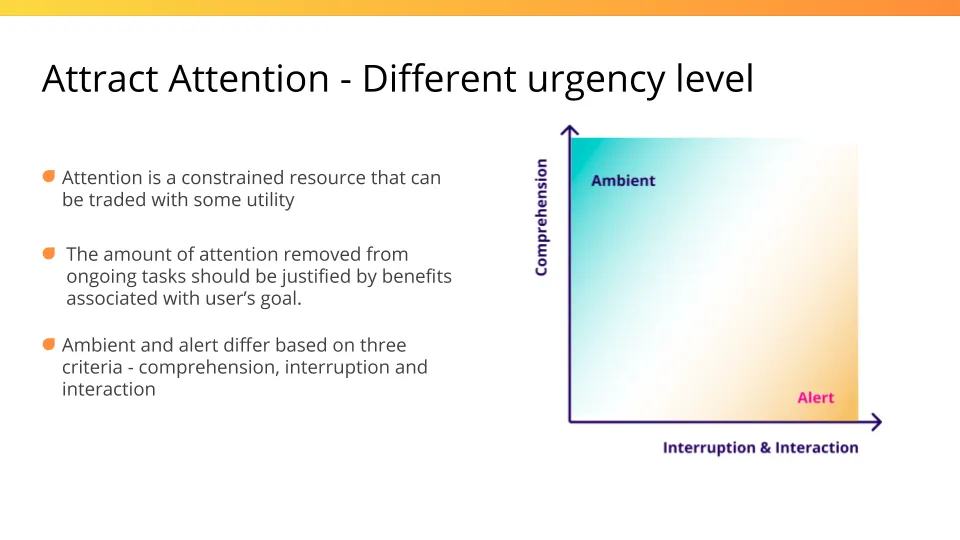

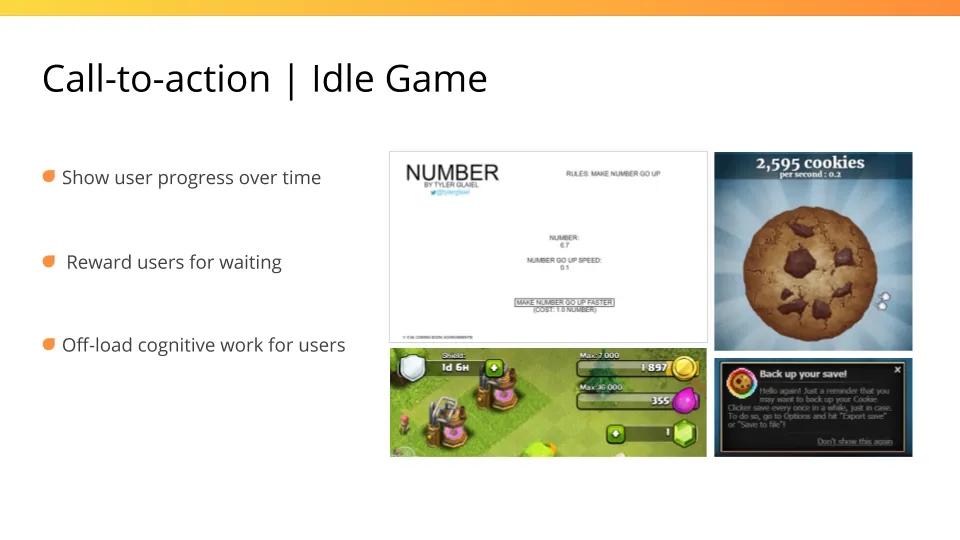

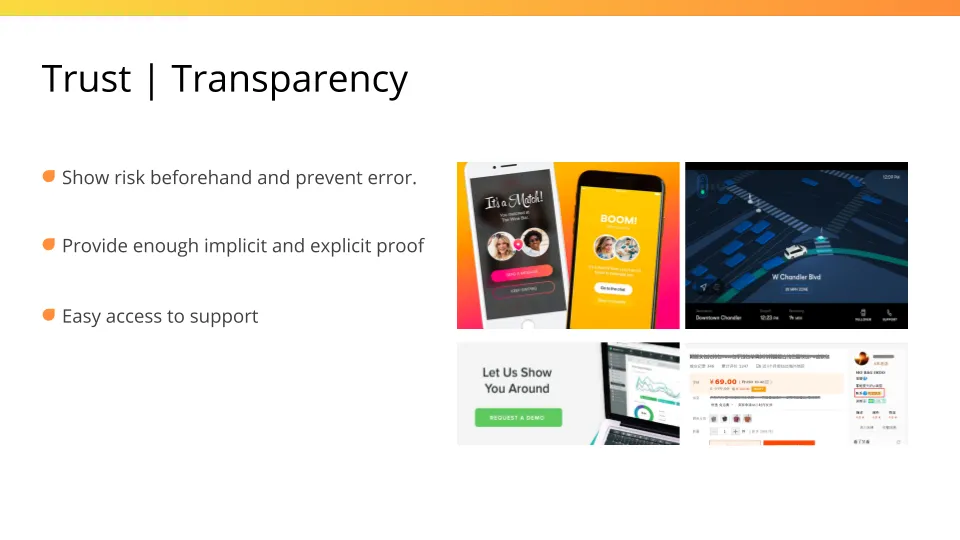

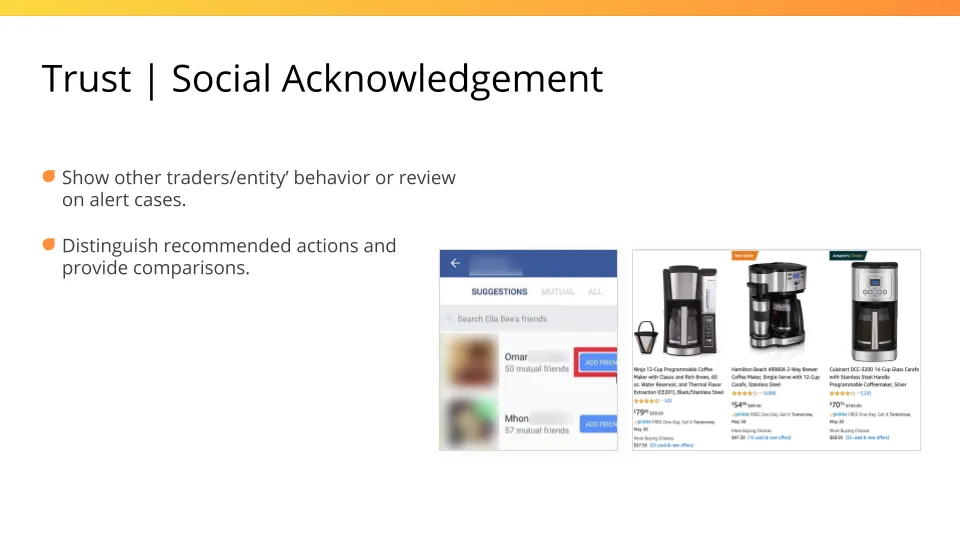

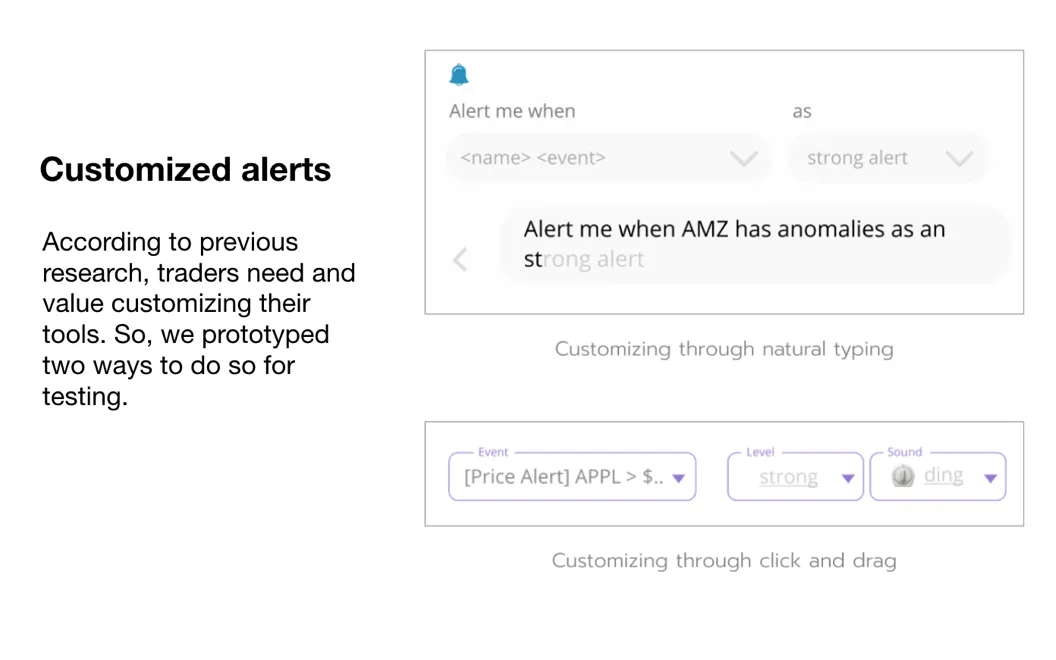

After having a holistic understanding of the domain, users, and product, we start to focus more on the alert system design. This section talks about how we generated a set of design guidelines based on analogous domain research and evaluative research.